income tax rates 2022 australia

2 Allowances earnings tips directors fees etc 2022. Tax on this income.

Banking Financial Awareness 6 7th May Awareness Banking Financial

Tax rates and codes.

. Tax on this income. See more information at Base rate entity company tax rates. This is because you may be entitled to a concessional rate of tax if you have certain amounts.

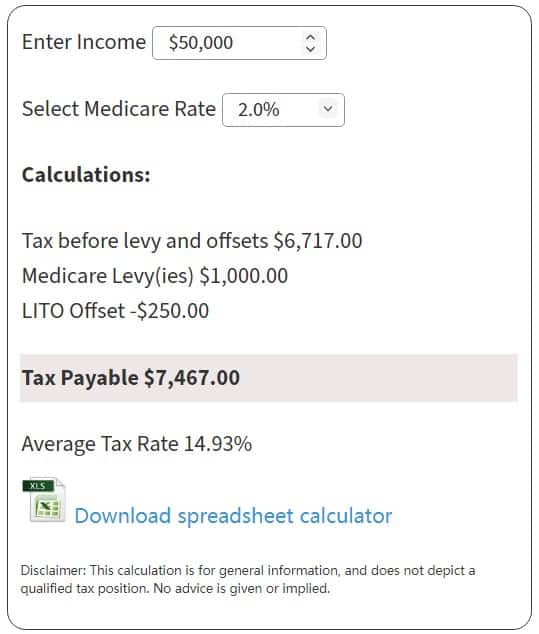

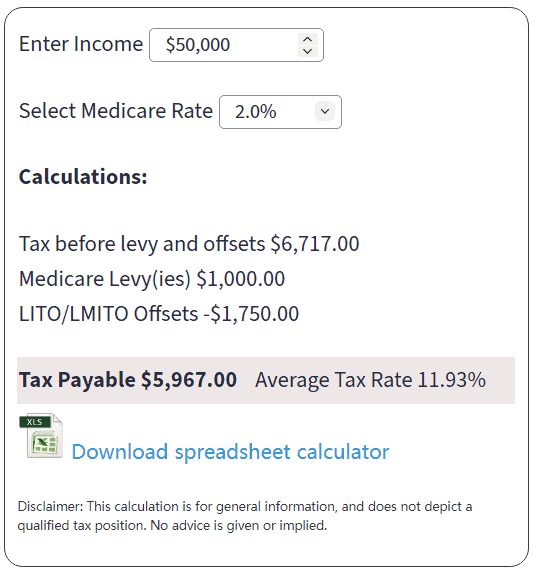

The corporate tax rate for base rate entities for 202122 is 25. An FBT rate of 47 applies across these years. 29467 plus 37 cents for each 1 over.

Tax Rates 2022-2023. 325c for each 1. Australian Finance reported Calculated Tax Rate of 3472 in 2021.

325c for each 1. These myTax 2022 instructions are about other types of income you need to declare in myTax. As a result of the Personal Income Tax Plan an individual earning 90000 each year around the average full-time income will benefit by a total reduction in tax of 8655 from 201819 to.

Australia Personal Income Tax Tables for 2022. 2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in Australia. Taxable income Tax on this income.

Make sure you click the apply filter or search button after entering your. Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. The next phase of the tax cuts will eventually remove the 325 and 37 marginal tax rates which will result in around 94 of Australian taxpayers facing a marginal tax rate of.

Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later. 5 rows Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to.

1 Salary or wages 2022. You are viewing the income tax rates. Tax on this income.

You can find our most popular tax rates and codes listed here or refine your search options below. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2. 19 cents for each 1 over 18200.

Taxable Income Tax Rate. 6 rows Income thresholds Rate Tax payable on this income. FBTFringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years.

19c for each 1 over 18200. Australia Personal Income Tax Rate was 45 in 2022. 3 Employer lump sum payments 2022.

39000 plus 37c for each 1 over 120000. New and modified items in the Company tax. Fringe benefits tax - historical rates.

ATO Tax Rates 2021-2022 Year Non-Residents Non-resident Tax scale 2021-22. Tax Rates for 2021-2022. Two further incentive regimes are proposed.

Australian Finance Calculated Tax Rate is fairly stable at the moment as compared to the past year.

Australian Income Tax Brackets And Rates For 2022

We Used Data And Science To Determine The Whitest States In America States In America America States

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

Best Erath County Tax Office Motor Vehicle Courthouse Annex Ii In 2022 Courthouse Ukiah Motor Car

How To Pay Tax In Spain And What Is The Tax Free Allowance

1040 Income Tax Cheat Sheet For Kids Income Tax Consumer Math Financial Literacy

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

A Teenager Tracked Elon Musk S Jet On Twitter Then Came The Direct Message In 2022 Elon Musk Tweet Quotes Messages

Australia Medicare Card Template In Psd Format Fully Editable Gotempl Templates With Design Service In 2022 Medicare Templates Online Activities

Australian Tax Rates And Brackets For 2021 22 Atotaxrates Info

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates

Get An Overview Of The Steps Involved In Employing A Foreign Domestic Worker Fdw In Singapore As Well As The Rules Set Out Domestic Worker Singapore Foreign

Imf Budget Is A Thoughtful Policy Agenda In 2022 Budgeting Thoughts Capital Investment

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

4x Trading Journal In 2022 Successful Teachers Journal Template Decision Fatigue